how to pay indiana state withholding tax

If you cannot locate this number please call the agency at 317-233-4016. Register and file this tax online via INTIME.

Irs Form 945 How To Fill Out Irs Form 945 Gusto

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax accounts in one convenient location 247.

. Find Indiana tax forms. You may also need to complete the FT-1 application for motor fuel taxes including special fuel or transporter taxes or the AVF-1 application for aviation fuel excise tax. You have two options for electronic payments.

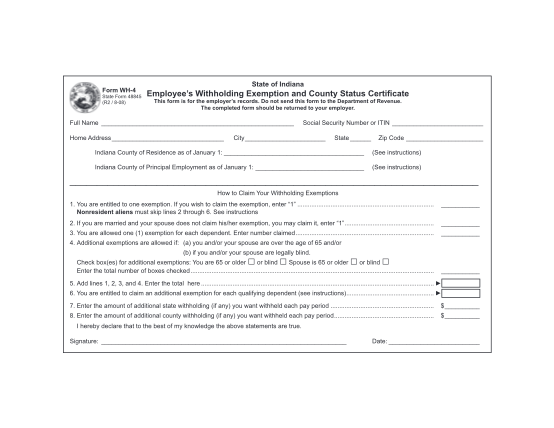

Preparation by Department - 20 penalty. Once registered an employer will receive an Indiana Taxpayer Identification Number. Print or type your full name Social Security number or ITIN and home address.

You will have the option to make or schedule a tax payment up to 30 days in advance or you may file the return firstAfter the return is submitted you will receive a message asking if you would. That said local income tax is typically based on either of the following. Apply online using the IN BT-1Online Application and receive a Taxpayer ID number in 2-3business days.

If you are required to withhold federal taxes then you must also withhold Indiana state and county taxes. Register with the Indiana Department of Revenue. Failure to file a tax return.

You will receive your Tax ID within a few hours of completing the online registration. If your status is married filing jointly you can earn 89000 for the full deduction or 109000 for. The aggregate of Indian state income tax and local tax applicable in a county within the state of Indiana are taken along with the allowed personal exemption and exemption for dependentsYou can also check federal paycheck tax calculator.

Once in the employee record Click the Payroll Info tab. Have more time to file my taxes and I think I will owe the Department. Payment of withholding tax is made online using iTax which generates a payment slip that must be shown at any of the designated KRA banks in order to pay the tax owed to the KRA.

You can also make your estimated tax payment online via INTIME at intimedoringov. Claim a gambling loss on my Indiana return. Indiana Withholding Tax Voucher.

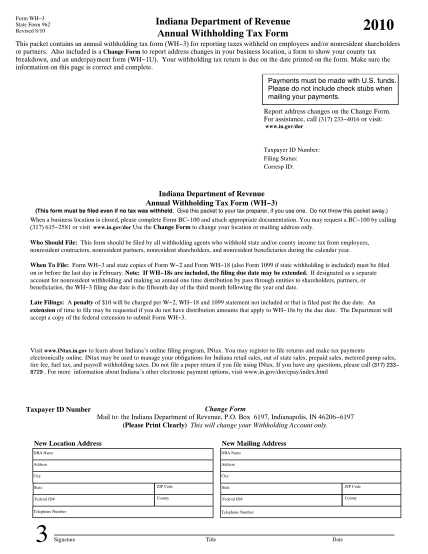

This form should be completed by all resident and nonresident employees having income subject to Indiana state andor county income tax. Annual Withholding Tax Form. Pay my tax bill in installments.

This penalty is also imposed on payments which are required to be remitted electronically but are not. However as of 2013 all Indiana withholding tax payments and WH-1s must be filed electronically. However in recent years the rate has been stable at 25.

Up to 25 cash back Formerly many Indiana withholding tax payers could pay on paper by sending in Form WH-1 Indiana Employers Withholding Tax Return with a check. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Know when I will receive my tax refund.

Failure to file a tax return. Register and file this tax online via INTIME. Take the renters deduction.

Up to 25 cash back The state UI tax rate for new employers also known as the standard rate also may change from one year to the next. Register online with the Indiana Department of Revenue on INBiz. You can also find an existing Taxpayer ID Number.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Make a payment online with INTIME by electronic check bankACH - no fees or debitcredit card fees apply Make a payment in person at one of DORs district offices or downtown Indianapolis location using cash exact change only personal or cashiers check money order and debitcredit cards fees apply. Claim a gambling loss on my Indiana return.

A fixed dollar amount regardless of how much the employee earns. Different tax withholding rates may apply to residents and nonresidents. Pay my tax bill in installments.

Withholding payments must be made to DOR by the due dates or penalties and interest will be assessed. INtax only remains available to file and pay the following tax obligations until July 8 2022. Register and file this tax online via INTIME.

Know when I will receive my tax refund. Payments can also be made using Mpesa. There are income restrictions if you or your spouse has a retirement plan through your employer.

From the Business Details page click Pay in the left menu. Take the renters deduction. Indiana tax calculator is an easy tool for computing the amount of withholding tax on your salary income.

Fraudulent intent to evade tax - 100 penalty. Employers required by the Internal Revenue Service to withhold income tax on wages must register with the Indiana Department of Revenue DOR as a withholding agent online through INBiz httpinbizingov. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov.

Bad checks - A flat 35. There are several ways you can pay your Indiana state taxes. Friday April 22 2022.

If you dont have a bill or dont know the amount due you can get assistance by calling the Indiana Department of Revenue at 317-232-2165. INTAX only remains available to file and pay special tax obligations until July 8 2022. To register for Indiana business taxes please complete the Business Tax Application.

Failure to pay tax - 10 of the unpaid tax liability or 5 whichever is greater. Have more time to file my taxes and I think I will owe the Department. A representative can research your tax liability using your Social Security number.

Any money withheld must be remitted to KRA by the 20th day of the next month unless otherwise specified. How to pay indiana state withholding tax. If you do not file a return and pay the proper amount of tax you will face criminal prosecution for fraud or tax evasion.

A flat percentage eg 1 or 2 of taxable wages A tax rate that goes up as the employees pay increases. Find Indiana tax forms. You may copy and paste this number directly into Zenefits hyphen included.

For single or head of household status the limit is 56000 for a full 5000 deduction and 66000 for a partial deduction. Enter your Indiana county of residence and county of principal employment as of January 1 of the current year. The DORs INtax system or electronic funds transfer EFT.

This will be your Location ID as listed on your Withholding Summary. Underpayment of Indiana Withholding Filing. Businesses in the construction industry pay a higher starting rate The new employer rate usually remains in effect for at least 36 months.

State Income Tax Withholding Considerations A Better Way To Blog Paymaster

16 Printable Indiana State Tax Withholding Form Templates Fillable Samples In Pdf Word To Download Pdffiller

State W 4 Form Detailed Withholding Forms By State Chart

State W 4 Form Detailed Withholding Forms By State Chart

19 Indiana Tax Forms Free To Edit Download Print Cocodoc

A Basic Overview Of Indiana S Wh 4 Form For State Tax Withholding

A Basic Overview Of Indiana S Wh 4 Form For State Tax Withholding

Tax Withholding For Pensions And Social Security Sensible Money

19 Indiana Tax Forms Free To Edit Download Print Cocodoc

Peoplesoft Payroll For North America 9 1 Peoplebook

Lottery Tax Rates Vary Greatly By State

Calculating Your Withholding Tax Inside Indiana Business

Indiana Taxes For New Employees Asap Payroll Services

How Taxes Work Taxes Social Security Numbers Visas Employment Office Of International Affairs Indiana University Purdue University Indianapolis